Okay, here’s a draft blog article, aiming for a human tone, E-E-A-T, and SEO considerations as instructed:

Let's be honest, "happily ever after" rarely includes perfectly synchronized bank accounts. More often, it's a beautiful mess of differing spending habits, buried financial anxieties, and the occasional, "Honey, where did all the takeout money go?" argument. Money is a leading cause of stress in relationships, and blending two financial worlds can feel like navigating a minefield.

Managing money as a married couple (or any committed partnership) isn't about finding theoneright way. It's about findingyourright way. The way that honors both your individual needs and your shared goals. It’s about honest communication, mutual respect, and creating a financial roadmap that you both feel confident and secure following. It's also about understanding that financial peace doesn't happen overnight; it's a continuous journey of learning and adapting together.

The key to avoiding conflict? Treat your finances like you're building something together, not controlling each other. Think of it as merging onto a highway – you need to signal (communicate), adjust your speed (spending habits), and stay in your lane (respect boundaries) to avoid a crash. The goal isn't to become financial clones, but to become a financialteam.

How to Manage Money as a Married Couple (Without Conflict)

1. Open, Honest Communication: The Cornerstone

Let's ditch the financial secrets. Transparency is non-negotiable. Hiding purchases (even small ones) erodes trust and breeds resentment. Imagine finding out your partner has been secretly accruing credit card debt or funneling cash into a secret hobby. It's not just about the money; it's about the betrayal of confidence.

Actionable Tip: Schedule regular "money dates." Grab a coffee, open your banking apps, and talk openly about your income, expenses, and financial goals. These dates shouldn’t be about blame; they’re about collaborative problem-solving.

Example: Sarah avoids these money talks because she feels ashamed of her shopping habits. Mark, her husband, gently initiates these conversations by sharing his own financial worries first. He admits his anxiety about retirement savings and asks for her support. This vulnerability creates a safer space for Sarah to be honest about her spending. They agree to set a small, guilt-free "fun money" budget for each of them, satisfying her shopping desires without jeopardizing their financial goals.

2. Determine Your Financial Style and Understand Your Partner's

Everyone has a unique relationship with money, shaped by their upbringing, experiences, and personality. Are you a spender or a saver? Risk-averse or adventurous? Understanding your own "money mindset" and your partner's is crucial.

Example: David grew up in a household where money was scarce, making him extremely frugal. Maria, on the other hand, came from a more affluent background and tends to be more relaxed about spending. This difference initially caused friction. David felt Maria was irresponsible, while Maria felt David was overly anxious. Through honest conversations, they realized their differing perspectives weren't inherently wrong, just different. They agreed to a balanced approach: David would manage long-term investments and savings, while Maria would handle the day-to-day budgeting, ensuring they both felt comfortable and secure.

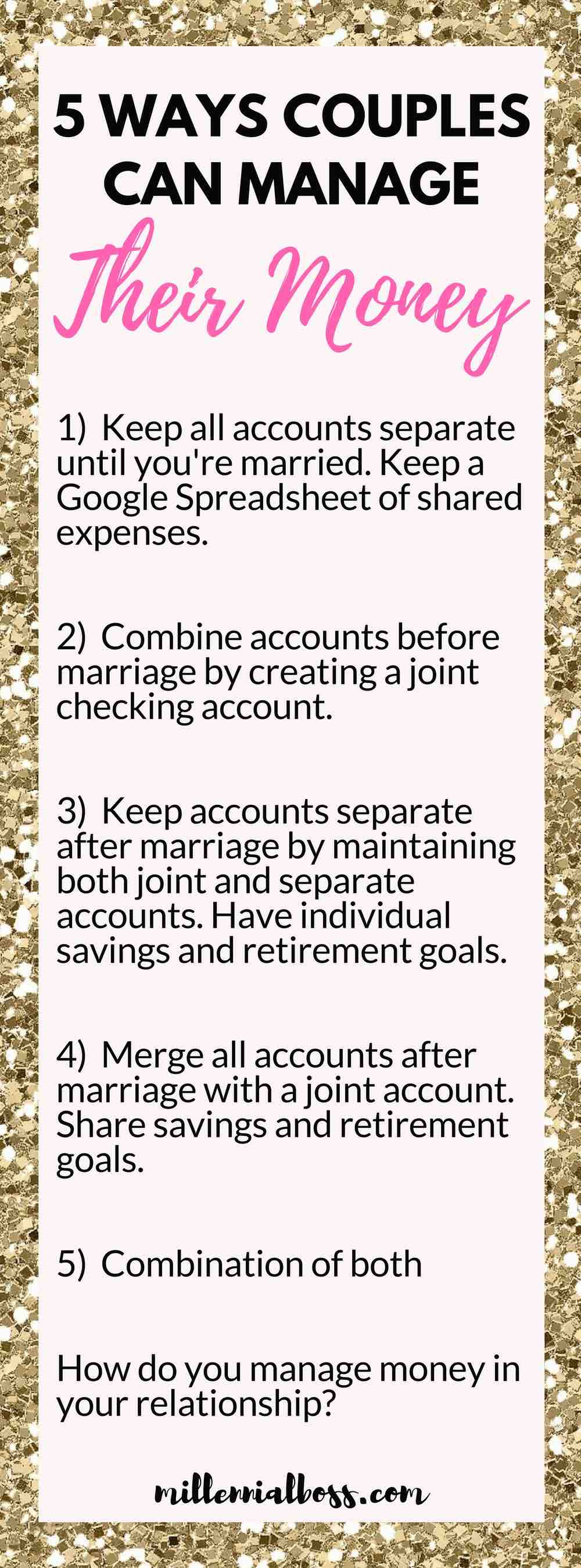

3. Choose a Money Management System That Works for You

There's no one-size-fits-all approach. Here are a few common options: Joint Account System: All income goes into a shared account, and all expenses are paid from it. This promotes transparency and simplifies bill paying. Separate Accounts System: Each partner maintains their own accounts and pays for their own expenses. This offers more autonomy but requires careful communication to ensure shared bills are covered. Hybrid System:A combination of joint and separate accounts. This is often the most popular option, providing both shared financial goals and individual financial freedom. A shared account covers household expenses, and each partner has their own account for personal spending.

Example: The Rodriguez family uses a hybrid system. They have a joint account for mortgage payments, utilities, groceries, and family activities. They also maintain separate accounts for personal expenses like clothing, hobbies, and entertainment. This allows them to save together for shared goals (a down payment on a vacation home) while still enjoying individual financial freedom.

4. Create a Realistic Budget (and Stick to It!)

A budget isn't a restriction; it's a roadmap to your financial goals. It helps you prioritize spending, track your progress, and identify areas where you can save money.

Actionable Steps

1.Track your spending: Use a budgeting app, spreadsheet, or even a simple notebook to track your income and expenses for a month.

2.Identify fixed expenses: These are recurring bills like rent/mortgage, utilities, insurance, and loan payments.

3.Identify variable expenses: These are expenses that fluctuate, like groceries, entertainment, and dining out.

4.Set financial goals: What do you want to achieve together? Saving for a down payment, paying off debt, traveling the world?

5.Allocate your income: Based on your expenses and goals, create a budget that allocates your income accordingly.

6.Review and adjust: Budgets aren't set in stone. Review your budget regularly and make adjustments as needed.

Budget Tip: The 50/30/20 rule is a simple framework: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment.

5. Don't Forget the Emergency Fund

Life throws curveballs. A job loss, unexpected medical expenses, or a major home repair can derail your financial progress. An emergency fund provides a financial cushion to help you weather these storms without resorting to debt.

Goal: Aim to save 3-6 months' worth of living expenses in a readily accessible savings account.

Example: The Johnsons experienced a sudden job loss. Thankfully, they had built up a six-month emergency fund. This allowed them to cover their expenses while Mr. Johnson searched for a new job, preventing them from accumulating debt and significantly reducing their stress levels.

6. Plan for the Future: Retirement and Investments

It's never too early (or too late) to start planning for retirement. Take advantage of employer-sponsored retirement plans (like 401(k)s) and consider opening individual retirement accounts (IRAs).

Important Note: Seek professional financial advice if you're unsure where to start. A financial advisor can help you create a personalized investment strategy based on your risk tolerance and financial goals.

Example: Maria and David, after finally creating a financial plan, realized they were both severely underfunding their retirement accounts. They consulted with a financial advisor who helped them understand the power of compound interest and develop a plan to catch up on their retirement savings. They also learned about different investment options and diversified their portfolio to mitigate risk.

7. Debt Payoff: A Unified Front

Debt can be a major source of stress in relationships. Work together to create a debt payoff plan. Whether you choose the snowball method (paying off the smallest debts first) or the avalanche method (paying off the highest-interest debts first), the key is to be united in your goal.

Example: The Smiths had accumulated significant credit card debt. They decided to tackle it together. They cut up their credit cards, created a strict budget, and allocated any extra income to debt repayment. They celebrated each milestone along the way, motivating them to stay on track.

8. Regular Check-Ins and Adjustments

Life changes. Income fluctuates. Goals evolve. Your financial plan should be a living document, not a static one. Schedule regular check-ins to review your progress, make adjustments, and ensure you're both still on the same page.

Example: The Joneses schedule a monthly "financial date night." They review their budget, track their progress toward their goals, and discuss any upcoming expenses or changes in their financial situation. This allows them to stay proactive and address any potential problems before they escalate.

9. Forgive Past Mistakes

We all make financial mistakes. Dwelling on past errors only creates resentment and hinders progress. Focus on learning from your mistakes and moving forward together. Remember, every couple messes up, but those who thrive learn how to communicate well after the inevitable financial blunders.

Building a solid financial foundation as a couple takes work, patience, and a healthy dose of understanding. It’s not always easy, but the reward – a secure and fulfilling future together – is well worth the effort. Remember, the journey is just as important as the destination. Enjoy the process of learning and growing together financially, and remember to celebrate your successes along the way. A little financial planning can go a long way toward a harmonious "happily ever after."